The ocean and its coastal zones is critical to tourism. According to the UN Environment Programme (UNEP) almost 70 million trips are taken each year just to visit coral reefs, generating US$36 billion a year in revenue and creating 6.5 million jobs[1]. Marine protected areas (MPAs) provide a wide variety of ecosystem services, conserving important biodiversity, serving as nursery grounds for fisheries and enhancing fish stocks, protecting habitats that buffer the impacts of storms and waves, and removing excess nutrients and pollutants from the air and water. They can also provide more sustainable tourism and recreational benefits, as well as enhance other non-use values such as cultural and heritage values.

The COVID-19 pandemic has put a spotlight on the reliance of many biodiversity hotspots, parks and marine protected areas on tourism revenues. The travel and tourism industry globally recorded an estimated loss of $1.2 trillion in export revenues in 2020[2]. In the Galapagos Islands, for example, a study projected that a six-month entry restriction for pandemic reasons would lead to the loss of 53 percent of the islands’ total yearly income, or nearly $10 million[3]. In parts of East Africa, wildlife poaching, illegal hunting and fishing, logging and bush-burning has increased due to the lack of tourism revenue and the resulting cuts in funding for park rangers and security[4].

This is an opportune time to rethink the sustainability of existing coastal and marine assets and develop opportunities for their expansion. The absence of tourism revenue resulting from COVID-19 travel restrictions has made a clear case for coastal and marine resources to adopt alternative and non-consumptive and regenerative revenue streams. At the same time, governments, development institutions and investors are recognising that these coastal and marine resources have intrinsic values beyond their current uses for tourism and fisheries. The ocean helps regulate global temperatures and the global carbon cycle by absorbing nearly one-third of atmospheric carbon dioxide. This ‘blue’ carbon is sequestered in coastal ecosystems such as mangroves, seagrasses and reef systems, which have a great capacity to store carbon in their sediments over long time scales. Vegetated coastal habitats represent one of the most efficient carbon sinks naturally available and are therefore an important tool for climate mitigation and adaptation, in addition to being crucial habitats hosting rich biodiversity and providing key ecosystem services. Typically, these coastal ecosystems belong to governments, which also bear the costs for their management and conservation as a public goods.

International agreements and commitments[5] over the past decade are increasingly bringing together sovereign nations and their central banks, financial markets, the private sector, donors, non-governmental organisations and philanthropists towards common goals to increase the flow of financing to the valuation and protection of marine ecosystems. Demand is driven by the shareholders and financiers of private sector companies who want to contribute positively to climate and biodiversity targets agreed in international conventions[6]. The goal is to create a supply of new products by attaching monetary values to ecosystem services, carbon and biodiversity by forming new types of marketplaces that allow these ecosystem values to be measured and monitored, independently verified and traded in largely voluntary markets.

Challenges

Despite the demand for blue assets, a range of challenges are preventing the growth of financing into this space. These could be characterised from both the demand side and the supply side. Buyers of blue assets (demand side) need transparent and internationally accepted standards, frameworks and common verification systems to invest with confidence. As noted by the High Level Panel for a Sustainable Ocean Economy, current frameworks and taxonomies on which investments to support do not adequately communicate with each other and are not yet being guided by universally adopted principles[7]. Without this international framework and common understanding of what constitutes a taxonomy of blue assets and how they are measured, monitored and maintained, the supply side (governments and asset developers) is uncertain about the rules of the game. These information asymmetries and coordination failures distort market dynamics to the extent that the only financing models moving forward are bespoke and small-scale. In addition to these framework issues, governance systems around the use of financing, benefit-sharing mechanisms and market structures for trading blue assets are still nascent. Investing in blue assets is risky in the context of these still-developing regulatory frameworks. While international accords like the Paris Climate Agreement are in place, the details are still unclear. There is also a lack of supply of high-quality, verified and investible blue projects.

Asset creation

With a global portfolio of more than $9 billion in investments in oceanic and ocean-related sectors, the World Bank is in a unique position to address these challenges. There is a compelling rationale for development institutions to support asset creation not only by creating the enabling environment for investments but also by de-risking an initial pipeline of investible projects.

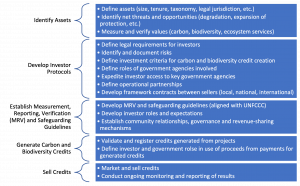

The following would be a process for asset creation at a country level. The process starts on the supply side by raising government interest and awareness and identifying and valuing potential blue assets; it then develops investment protocols, measurement protocols and means of verification before finally trading the credits.

Figure 1. Process of asset creation for a blue economy

Source: Authors’ diagram.

Governments need advice, capital, and resources to help create institutional and transparent legal, regulatory, and accounting frameworks for both carbon and biodiversity credits that enable this market to move faster and at greater scale. This framework would be like the one required to set up an investment climate for any ‘new’ industry. Getting the rules in place could help create standardised carbon and biodiversity assets that can be sold to companies or financial markets that have pledged to reach net-zero emissions, for example. It would also create space for governments to operate beyond their protected area systems by offering high-potential ecosystems for private and community ownership or lease—for instance, in buffer zones around MPAs.

Financing options

The core argument presented here is that coastal and marine resources have the potential to generate revenue streams beyond traditional fisheries and tourism. For these areas to be more resilient, they must do this. While the focus of this essay is on financing mechanisms for ecosystem services and carbon and biodiversity payments, it is also important that coastal and marine ecosystems dependent on tourism adopt more circular-economy practices and improve governance and local management of these ecosystems to facilitate regenerative practices (of waste and plastics, for instance). Local communities and businesses will need training to enable their inclusion in these value chains. The World Bank Group (WBG) is working on many of these areas in the Caribbean, West Africa and other regions through PROBLUE, a multi-donor trust fund administered by the World Bank that supports sustainable and integrated development of marine and coastal resources in a healthy ocean[8].

A further entry point for the WBG and other development partners could be in structuring and providing financing instruments to de-risk projects and leverage different types of capital from different providers who require different types of returns. This could include a range of structures and instruments:

- Blended finance: Strategic development finance and philanthropic grants that attract and mobilise additional commercial finance; increase the project’s scope, range and effectiveness; and deliver risk-adjusted returns in line with market expectations.

- Blue bonds: Fixed-income financial instruments where capital is invested upfront in initiatives that deliver measurable outcomes, such as carbon and biodiversity credits. The need for verified outcomes is paramount because investors get repaid only for proven results. This is perhaps the most common instrument currently used, as exemplified in the Seychelles.

- Debt swaps: Debt-for-nature swaps that leverage funds for use in local conservation efforts based on the model of debt-for-equity swaps. Proceeds are invested in conservation activities in the indebted country. A debt swap can also involve debt forgiveness. Blue carbon credits are generated through a wide range of activities that sequester carbon or demonstrate biodiversity conservation metrics.

- Conservation or endowment funds (hybrid model): Typically grant-making entities that provide finance for conservation activities. They are capitalised by governments, foundations and the private sector. Often there is no expectation of a return, enabling the funds to support higher-risk projects with less-certain outcomes.

- Carbon credits: Generated through a wide range of activities that sequester carbon; blue carbon refers to sequestration in marine and coastal ecosystems (mangroves, tidal wetlands, seagrasses, etc.). Although examples are limited, the field is growing and can build on the experience gained in terrestrial carbon sequestration.

- Parametric insurance products: Developed for various oceanic sectors. The Caribbean Oceans and Aquaculture Sustainability Facility, the world’s first parametric insurance, was developed by the World Bank for the fisheries sector to catalyse resilience and sustainable management of the marine environment. It promotes formalisation of the sector by giving fishers incentives to register in order to benefit from the insurance scheme. It aims ultimately to reduce the natural disaster risk that climate change poses to food security and foster policy reforms that promote climate-smart fisheries practices and coastal resilience.

The sustainability of marine and coastal assets is vital to the tourism sector and to the battle against climate change. Despite their importance, these blue assets have been historically undervalued and poorly managed. COVID-19’s impact on tourism and the increasingly urgent climate crisis has put a spotlight on the need for a fundamental change in the valuation, financing and management of these resources. Development partners have an important role to play in creating the enabling environment for and promoting private sector investment in sustainable ocean resources.

—–

[1] R. Brumbaugh, “Protecting Million Dollar Reefs Is Key to Sustaining Global Tourism,” UN Environment Programme, 10 May 2017, https://www.unep.org/news-and-stories/story/protecting-million-dollar-reefs-key-sustaining-global-tourism.

[2] World Tourism Organization, “2020: Worst Year in Tourism History with 1 Billion Fewer International Arrivals,” 28 January 2021, https://www.unwto.org/news/2020-worst-year-in-tourism-history-with-1-billion-fewer-international-arrivals.

[3] J.P. Díaz-Sánchez and M. Obaco, “The Effects of Coronavirus (COVID-19) on Expected Tourism Revenues for Natural Preservation: The Case of the Galapagos Islands,” Journal of Policy Research in Tourism, Leisure and Events 13, no. 2 (2021): 285–89.

[4] S. Roberts, “Africa’s Year of Zero: A Special Report on the Future of Wildlife Tourism,” Financial Times, 28 October 2020, https://www.ft.com/content/6a4f6c76-8a00-46ef-a645-23a5eda58825.

[5] Including the Aichi Declaration (2011), the Paris Agreement (2015), and the Glasgow Declaration (2021).

[6] For instance, Target 11 of the Aichi Declaration: “By 2020, at least 10 per cent of coastal and marine areas, especially areas of particular importance for biodiversity and ecosystem services, are conserved through effectively and equitably managed, ecologically representative and well-connected systems of protected areas and other effective area-based conservation measures and integrated into the wider landscapes and seascapes.”

[7] Aichi Declaration, Target 11.

[8] World Bank, PROBLUE, home page, https://www.worldbank.org/en/programs/problue.

Previous

Previous